CVS Health, the iconic American pharmacy chain, has been a reliable player in the healthcare landscape for decades. But can its success translate into future returns for investors? In this article, we’ll analyze the factors influencing CVS Health’s stock price and attempt to predict where it might head in the coming months and years.

The Future of CVS Health Stock

Current Landscape:

As of today, January 31, 2024, CVS Health stock sits at $73.85 (USD). Despite recent market fluctuations, it has shown a relatively stable upward trend over the past year, reaching a 52-week high of $76.28. This stability reflects the company’s strong fundamentals, including:

- Dominant Market Position: CVS Health boasts a massive network of over 9,000 retail locations across the United States, giving them a significant reach and market share in the pharmacy industry.

- Diversified Revenue Streams: Beyond traditional pharmacy services, CVS Health focuses on growing its clinics, healthcare services, and digital operations, creating multiple income channels for increased resilience.

- Solid Financials: The company consistently reports strong revenue and earnings growth, with analysts projecting continued profitability in the future.

Bullish Drivers:

Several factors suggest potential for further growth in the CVS Health stock price:

- Aging Population: The rapid growth of the aging population in the US creates a long-term demand for pharmacy services and healthcare products, benefiting CVS Health directly.

- Healthcare Expansion: CVS Health’s strategic expansion into healthcare services, including primary care and chronic disease management, offers significant growth potential and diversification.

- Digital Transformation: Investments in its online and mobile platforms, including prescription delivery and telehealth services, could increase customer engagement and loyalty.

- Potential M&A Opportunities: With its strong financial position, CVS Health might strategically acquire smaller players in the healthcare space, further solidifying its market presence.

Bearish Concerns:

However, some challenges could slow down or even reverse CVS Health’s upward trajectory:

- Increased Competition: Online pharmacies and other retail giants like Amazon are vying for market share, putting pressure on prices and profits.

- Healthcare Policy Changes: Shifting government policies and regulations in the healthcare industry could impact revenue streams and business models.

- Macroeconomic Trends: Global economic slowdowns or inflation spikes could affect consumer spending and healthcare utilization, impacting CVS Health’s bottom line.

Read More: What is CDC in Crypto?

Analyst Predictions:

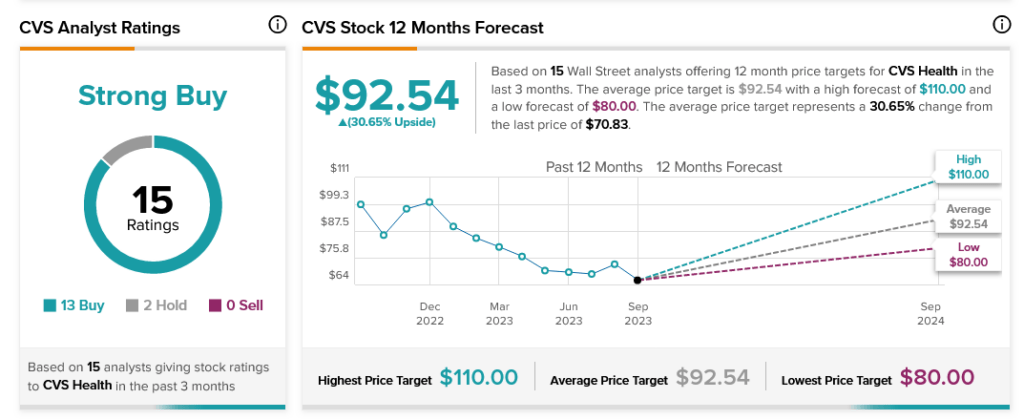

While predicting the future is never a foolproof task, reputable analysts generally hold a positive outlook on CVS Health. The average 12-month price target from 22 Wall Street analysts stands at $90.53, representing a potential 24.01% increase from the current price. Additionally, the consensus rating among analysts is “Strong Buy,” indicating confidence in the company’s future performance.

Navigating the Uncertainty:

Investing in any stock is inherently risky, and even the most promising predictions can be upended by unforeseen circumstances. For investors considering CVS Health, it’s crucial to conduct thorough research, factor in their risk tolerance, and diversify their portfolio.

Final Thoughts:

CVS Health stands poised for continued growth and success in the future. Its strong fundamentals, diverse revenue streams, and strategic expansion plans create a compelling case for potential long-term returns. However, navigating the market’s ever-changing tides requires awareness of potential challenges and responsible investment practices. By carefully analyzing the landscape and understanding the risks involved, investors can make informed decisions about whether CVS Health is a fit for their portfolio.

Read More: Understanding Cryptocurrency Regulation: Navigating the Complexities of the Crypto Landscape