Welcome to our comprehensive guide on Principal 401k, covering topics such as withdrawal, customer service, cashing out, rollover, terms and conditions, and phone numbers. In this article, we will provide you with all the essential information you need to know about managing your Principal 401k account effectively. Whether you are considering a withdrawal, have questions about customer service, or are looking for guidance on a rollover, we’ve got you covered.

What is a Principal 401k?

A Principal 401k is a retirement savings plan offered by Principal Financial Group, one of the leading financial services providers. It allows employees to contribute a portion of their pre-tax income towards their retirement savings. The contributions grow tax-deferred until withdrawal, making it a valuable tool for building a secure retirement nest egg.

Principal 401k Withdrawal: Explained

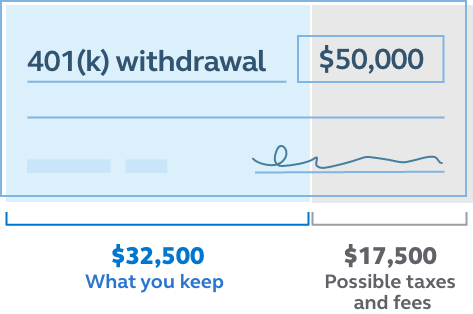

When it comes to withdrawing funds from your Principal 401k, it’s essential to understand the rules and implications. A Principal 401k withdrawal refers to the process of taking money out of your retirement account before reaching the age of 59 ½. However, early withdrawals may be subject to income tax and an additional 10% penalty fee imposed by the IRS.

https://youtu.be/ZEvGRM4s20k

To make a Principal 401k withdrawal, you need to meet certain criteria. These include financial hardships, disability, separation from service, or reaching the age of 59 ½. It’s crucial to consult with a financial advisor or tax professional to understand the tax implications and make informed decisions.

Understanding Principal 401k Customer Service

Principal 401k provides excellent customer service to ensure participants have a smooth and hassle-free experience managing their retirement accounts. If you have any questions or need assistance, you can reach Principal 401k customer service through various channels.

The most convenient way to contact Principal 401k customer service is by phone. You can call their dedicated customer service line at [insert phone number here]. Their knowledgeable representatives will guide you through any queries you may have regarding your account, contributions, withdrawals, or any other concerns.

How to Cash Out Your Principal 401k

Cashing out your Principal 401k means liquidating the funds in your retirement account. However, before you decide to cash out, it’s important to consider the potential tax consequences and long-term impact on your retirement savings.

To cash out your Principal 401k, you typically have a few options. You can choose to receive a lump sum payment, roll the funds into an Individual Retirement Account (IRA), or transfer them to a new employer’s retirement plan. It’s advisable to speak with a financial advisor to evaluate the pros and cons of each option and determine the best course of action based on your unique circumstances.

Principal 401k Rollover: A Smart Move

A Principal 401k rollover involves transferring funds from your Principal 401k account to another retirement account, such as an IRA or a new employer’s retirement plan. Rollovers can offer several benefits, including increased investment options, flexibility, and potential tax advantages.

By rolling over your Principal 401k, you gain greater control over your retirement savings and have the opportunity to explore alternative investment strategies. It’s crucial to understand the rollover process, including any fees or penalties involved, to make an informed decision. Consult with a financial advisor to assess your options and determine the most suitable approach for your retirement goals.

Terms and Conditions for Principal 401k Withdrawal

Before initiating a Principal 401k withdrawal, it’s crucial to familiarize yourself with the terms and conditions set by Principal Financial Group. The terms and conditions provide guidelines on eligibility, tax implications, penalties, and other important details associated with withdrawals.

To access the specific terms and conditions for Principal 401k withdrawal, visit the official Principal Financial Group website. They maintain comprehensive documentation outlining the rules and regulations governing withdrawals. Taking the time to review these terms and conditions ensures you make well-informed decisions and avoid any unexpected surprises.

Principal 401k Withdrawal Phone Number: Contacting Support

If you need immediate assistance or have urgent inquiries related to Principal 401k withdrawal, contacting their dedicated support team via phone is the fastest and most efficient option. The Principal 401k withdrawal phone number is [insert phone number here].

By reaching out to the Principal 401k withdrawal support team, you can receive prompt answers to your questions, guidance on the withdrawal process, and assistance in navigating any challenges you may encounter. Their knowledgeable representatives are well-equipped to provide the support and information you need to successfully manage your Principal 401k account.

Frequently Asked Questions

FAQ 1: Can I withdraw money from my Principal 401k?

Yes, you can withdraw money from your Principal 401k. However, it’s important to understand the eligibility criteria, tax implications, and potential penalties associated with early withdrawals. Consult with a financial advisor or review the terms and conditions provided by Principal Financial Group for detailed information.

FAQ 2: How can I contact Principal 401k customer service?

To contact Principal 401k customer service, you can call their dedicated support line at [insert phone number here]. Their representatives will assist you with any questions or concerns regarding your account, contributions, withdrawals, or other related matters.

FAQ 3: What are the options to cash out my Principal 401k?

When cashing out your Principal 401k, you have several options. You can choose to receive a lump sum payment, roll the funds into an IRA, or transfer them to a new employer’s retirement plan. Each option has its own considerations, so it’s advisable to consult with a financial advisor to determine the most suitable approach for your needs.

FAQ 4: Is a rollover a good idea for my Principal 401k?

A rollover can be a smart move for your Principal 401k, as it offers increased investment options, flexibility, and potential tax advantages. However, the suitability of a rollover depends on your individual circumstances and goals. It’s recommended to seek advice from a financial advisor who can assess your situation and provide personalized guidance.

FAQ 5: What are the terms and conditions for Principal 401k withdrawal?

The terms and conditions for Principal 401k withdrawal can be found on the official Principal Financial Group website. Reviewing these terms and conditions is essential to understand the rules, eligibility criteria, tax implications, and any potential penalties associated with withdrawals.

FAQ 6: How can I reach the Principal 401k withdrawal phone number?

To reach the Principal 401k withdrawal phone number, simply dial [insert phone number here]. Their dedicated support team will be available to assist you with any questions or concerns related to your Principal 401k withdrawal.

Conclusion

Managing your Principal 401k account effectively requires a thorough understanding of withdrawal procedures, customer service channels, cashing out options, rollovers, terms and conditions, and how to contact support. By familiarizing yourself with these crucial aspects, you can make informed decisions that align with your retirement goals.

Remember to consult with a financial advisor for personalized advice based on your unique circumstances. Principal 401k provides valuable resources and assistance to help you navigate the intricacies of retirement planning and maximize the benefits of your account.

Read More: Apps to Invest Small Amounts of Money